Celebrating 30 years of experience, Royal Food Service confidently delivers the freshest and highest-quality produce with a personal touch

Previous slide

Next slide

Growing Area Forecast

May 2024

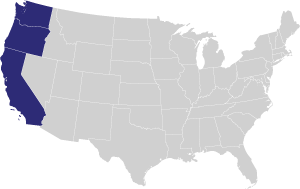

West Coast

West Coast

The California growing region can anticipate a dry, mild week ahead. Highs will begin in the low 60s and gradually rise to the mid to upper 70s by the weekend, with lows remaining steady in the lower 50s.

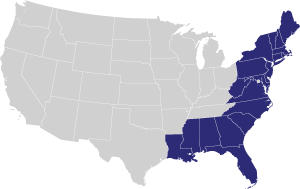

East Coast

East Coast

The Florida growing region can anticipate another warm week ahead, with highs ranging from the low to mid-90s and lows hovering around the mid-70s. Some scattered showers are forecasted towards the weekend.

Mexico

Mexico

This week, the growing regions of Mexico can anticipate mild temperatures, with highs ranging from the mid-60s to low-70s and lows in the upper 50s. There's no rain in the forecast for the week.

Local List

Fresh Report

Now in Season

Partners in Produce

1994

Royal Food Service has been family owned and operated since 1994. With a love for the community and helping others. Royal always has a personal touch. With produce, it’s personal.